Latest security alerts

At Allied Irish Bank (GB) we are committed to protecting you against the threats associated with internet and other types of fraud. Here, you will find details of specific current security threats to our customers and alerts that you should be aware of.

Phone Scam Warning

We are aware of fraudsters contacting business customers pretending to be AIB staff. If you receive such a call and suspect anything or are not comfortable, hang up the phone and ring back on a number you have independently verified.

Remember:

- AIB will NEVER ask you to reveal details of your IBB login, including password

- AIB will NEVER ask you to confirm approval limits

- AIB will NEVER ask you to generate a code from your digipass

Text Scam Alert

Fraudsters are targeting customers like you by sending text messages claiming to be AIB and/or other legitimate companies. These messages request you to click a link to review or block a fraudulent transaction on your account, or advise that you are locked out of your account. You may also be asked to input codes from your Card Reader or divulge a One Time Passcode (OTP).

These text messages are fraudulent.

NEVER disclose your Registration Number or Personal Access Code (PAC) or card information after clicking a link on a text.

NEVER generate codes from your AIB Card Reader when they are requested by a text message.

NEVER divulge your One Time Passcode (OTP) for Card transactions.

If you have received such a call or text message and have disclosed any information, please contact us immediately.

Email Scams

Criminals are sending scam emails in an attempt to trick you in to transferring money to them.

If you make and authorise a payment to one of these fraudulent accounts, it is highly unlikely that AIB will be able to get your money back for you.

Ensure that all your iBB Users are aware of these threats and that they should report any suspicious activity immediately.

For more information on how to stay safe, visit our Security Centre and Take Five Campaign.

- You should NEVER accept any financial instructions via email.

- You should always VERIFY ACCOUNT NUMBERS using a known contact number to your Manager / Director / Staff Member / Supplier.

SCAM ALERT:

Coronavirus

Fraudsters are using the publicity around the Coronavirus to pose as genuine organisations, including bank staff, government and/or health service officials, including the companies you pay regularly. They are claiming to help keep your money safe, or to offer investment and / or medical advice at a cost and can ask you to transfer funds to a different account.

Remember: AIB or other organisations, such as law enforcement agencies, will NEVER ask you to transfer money, move it to a safe account, nor ask you to disclose your security credentials, personal or financial information by phone, email or text message. Always verify account numbers with your supplier on a known contact number before you make a payment.

For additional information on these scams and more, visit Take Five Campaign.

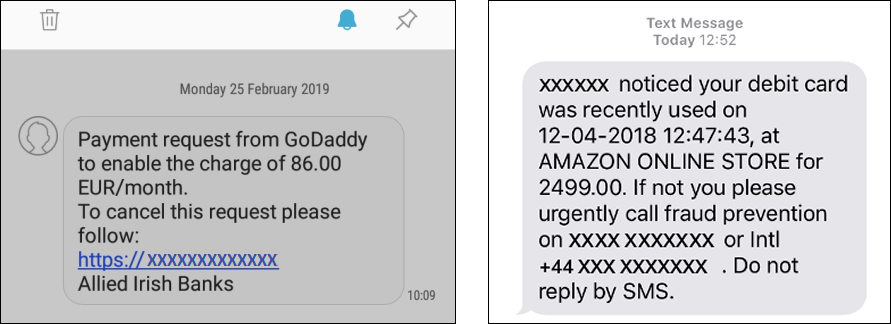

Fraudulent texts:

Criminals can make fake text messages look like they come from us. They can even insert these fake messages into genuine text conversations we are having with you.

One way of spotting a scam is that our web address will have .co.uk at the end. If it has any other ending like .com, it is definitely a scam.

Be careful and never click a link in a text message - even if it appears to be part of a conversation with us. We don't put links into our text messages.

Here are some examples of fraudulent texts pretending to come from us

If you believe you have received a fraudulent text message, email or phone call, please send a copy of the details to alert@aib.ie.

For further information to protect yourself against fraud, visit Take Five.

Fraudulent phone calls:

Criminals can call you pretending to be us. They can even mimic our phone number. But remember:

- We will never text you a One Time Passcode to cancel a transaction.

- We will never ask you to get a code from your Card Reader to cancel a transaction.

- We will never ask you not to log back into your account.

- You should not share a One Time Passcode code or Card Reader code with anyone if you get an unexpected call or text message, whoever they say they are, even if they say they are from our fraud team.

- We will never call you to ask for a code we have sent to you, or to ask why you didn't complete the process in the text message.

These codes are the way to make money leave your account. Never share them with anyone including bank staff

If you believe you have received a fraudulent text message, email or phone call, please send a copy of the details to alert@aib.ie.

For further information to protect yourself against fraud, visit Take Five.

Text Scam Alert

Fraudsters are targeting customers like you by sending text messages claiming to be AIB and/or other legitimate companies. These messages request you click a link to review or block a fraudulent transaction on your account or that you are locked out of your account. You will also be asked to input codes from your Card reader or divulge One Time Passcodes (OTP).

These text messages are fraudulent.

- NEVER disclose your Registration Number or Personal Access Code (PAC) or card information after clicking a link on a text.

- NEVER generate codes from your AIB Card Reader when they are requested by a text message.

- NEVER divulge your OTP for Card transactions.

If you have received such a call or text message and have disclosed any information, please contact us immediately.

For further guidance and useful tips on how to stay better protected from all types of Fraud, do refer to the UK Government ‘TakeFive’ advice, and remember to ‘Stop. Think. Challenge’.

Warning :

You are at risk of your Online Banking being taken over and misused by criminals if you do not keep your software up to date.

Use Anti-Virus software, ensure you are using supported browsers and operating systems and make sure you apply software updates.

- Phone Scam Warning

- Allied Irish Bank (GB) phone scams

- TV Licensing Scam

- TalkTalk/BT vhishing scams

- Current Security Alert - Malware Screens on iBB

- WARNING - ATTACKS BY ONLINE HACKERS ARE ON THE INCREASE

-

Phone Scam Warning

We are aware that fraudsters are contacting customers of First Trust Bank/AIB GB along with other banks requesting security details or asking customers to transfer money.

We would remind you that our staff will never ask for your security credentials or to transfer money.

-

Allied Irish Bank (GB) phone scams

Allied Irish Bank (GB) have been notified of a Phone Scam currently targeting our customers. Reports received to the Bank indicate that:

- Fraudsters purporting to be from Allied Irish Bank (GB) have been targeting customers asking them to make test payments from their account.- Callers claim that they are calling on behalf of Allied Irish Bank (GB) and can fake the caller identification to make it look as if the call is from a legitimate source.

Allied Irish Bank (GB) reminds customers to be vigilant and aware of such calls - they are not genuine.- Allied Irish Bank (GB) never requests you to make payments from your account to any account.- Allied Irish Bank (GB) never requests you to provide your security details.- If you suspect that a call may be fraudulent, or are unsure about the source of a call please hang up and call Allied Irish Bank (GB). -

TV Licensing Scam

Fraudsters have been issuing fake emails purporting to be from TV Licensing. The mail advises the victim that their Direct Debit has been cancelled and that the TV License cannot be automatically renewed. The victim is then requested to click on a link which directs them to a fake website where they enter their bank account details and other personal information. The victim will then receive a call from someone claiming to be from their bank and request that they provide their online registration and PAC. With this they will attempt to move funds out of the victim’s account.

Do not click on any link that has been provided in the email, and should you receive a call from anyone claiming to be from the Bank, we will never ask for your full PAC details to verify your identity.

-

TalkTalk/BT vhishing scams

We have seen an increase in telephone vhishing scams, with fraudsters claiming to be from telecoms providers, such as TalkTalk, BT and others, offering a refund. If you receive a call like this, hang up and call the provider back on a number you can verify using a different phone to the one you were called on. Do not give the caller remote access to your PC, and do not log into your Online Banking if instructed to do so by the caller. Never reveal your bank account details, PIN, the full 5 digits of your Personal Access Code (PAC) or codes from your code card / card reader over the phone. Fraudsters may ask for codes from your code card or card reader to transfer money to a safe account; do not comply.

If you feel you have been affected by this type of fraud or any other scam, call Us on 028 9034 6034 (8:30am to 17:00pm Mon to Fri) or email us at alert@aib.ie.

-

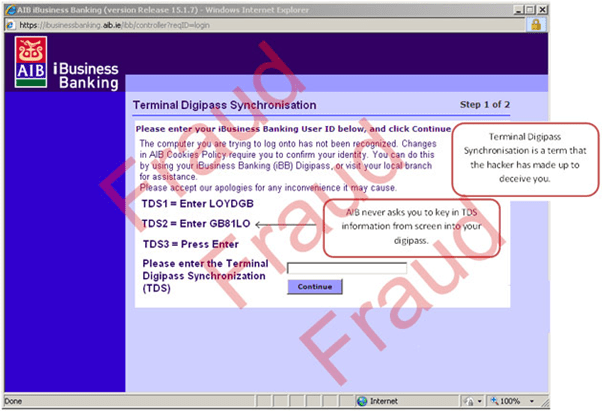

Current Security Alert - Malware Screens on iBB

We are aware of attempted fraud on iBB; screens that look like iBB screens are being used in an attempt to trick customers into making fraudulent payments.

Allied Irish Bank (GB) will NEVER ask you to key codes, presented to you on a screen, in to your Digipass.

Please remain vigilant of fraudulent activity.

-

WARNING - ATTACKS BY ONLINE HACKERS ARE ON THE INCREASE

How do you know that you are under attack?

- Bogus iBB screens or pop windows asking you to key details into your iBB Digipass (see the screen below)- Your PC slows down while using iBB – particularly at logon.- Suspicious phone calls are received purporting to be from Allied Irish Bank (GB) regarding iBB – asking you to create codes on your Digipass, perform test payments and/or authorise payments.

Remember: Always check that the Beneficiary details for payments you are authorising are legitimate.Example of a bogus iBB screen

While the screen below may look authentic, it is an example of a fraudster attempting to get security information from you to make a fraudulent payment.